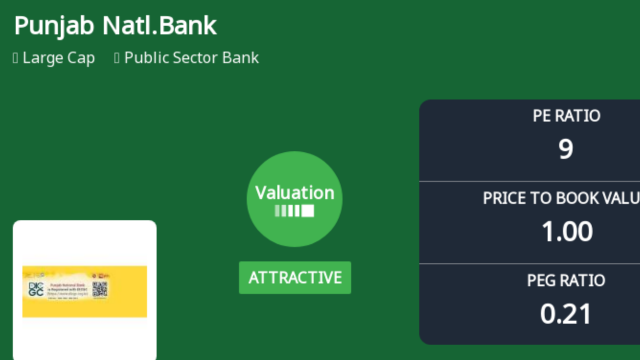

October 6, 2025 : Punjab National Bank (PNB), one of India’s leading public sector banks, has announced an adjustment in its valuation grade in response to a dynamic and competitive banking environment. The move comes as public sector banks face increasing pressure from private banks and digital financial services.

Reason for Valuation AdjustmenThe bank cited several factors for the revision, including:

- Rising competition from private banks offering higher interest rates and faster digital services.

- Changing regulatory requirements that impact lending and risk management.

- Market conditions affecting asset quality and growth projections.

Experts say that valuation grade adjustments help investors and stakeholders better understand the risk-return profile of the bank.

Impact on Investors

While the adjustment reflects the challenges in the sector, PNB reassured investors that its core operations remain strong. The bank emphasized:

- Sustained loan growth, particularly in retail and MSME segments.

- Improved digital banking services to compete with private sector rivals.

- Strong focus on non-performing asset (NPA) management to maintain financial stability.

Financial analysts suggest that while the revised valuation may affect short-term investor sentiment, PNB’s long-term prospects remain promising if growth strategies are successfully implemented.

Competitive Landscape in Public Sector Banking

Public sector banks in India are facing increasing competition due to:

- Private banks offering higher savings interest rates and attractive loan products.

- Rapid adoption of digital banking platforms that appeal to younger customers.

- Fintech startups providing innovative credit solutions and peer-to-peer lending services.

PNB’s adjustment is seen as a strategic response to remain competitive, transparent, and aligned with market realities.

Measures Taken by PNB

The bank is implementing several initiatives to strengthen its position:

- Digital Expansion – Upgrading mobile banking apps and online loan approval processes.

- Customer Engagement – Personalized financial products for high-value and retail clients.

- Operational Efficiency – Reducing operational costs while improving service delivery.

- Risk Management – Continuous monitoring of NPAs and restructuring loans when necessary.

Expert Commentary

Financial analyst Rajesh Kumar commented:

“PNB’s revised valuation grade reflects both the challenges and opportunities in public sector banking. It is a transparent move that helps investors make informed decisions.”

Kumar added that banks with strong governance and digital infrastructure are likely to retain customer trust and compete effectively with private and foreign banks.

Outlook

The banking sector in India is undergoing a phase of transformation, with technology, regulations, and customer expectations driving rapid changes. PNB’s adjustment signals that public sector banks are actively monitoring their performance and adapting to new realities.

The bank expects that by continuing to focus on digital banking, customer service, and risk management, it can maintain steady growth while navigating competition.

Conclusion

Punjab National Bank’s adjustment of its valuation grade highlights the competitive pressures on public sector banks in India. While short-term market reactions may vary, the move demonstrates strategic planning, transparency, and a commitment to long-term stability in a challenging banking landscape.

Summary

Punjab National Bank revised its valuation grade amid increasing competition from private banks and digital lenders. The move reflects strategic planning, transparency, and efforts to maintain growth in a competitive market.